Imagine waiting for years for that one big change that could finally make your hard work feel seen — that’s exactly how millions of government employees and pensioners feel right now. Rising prices, growing family needs, and a dream for financial security — the 8th Pay Commission feels like a light at the end of a long tunnel.

While the government hasn’t released official details yet, early signs and expert discussions have already sparked excitement across the country. Could this be the biggest salary boost in a decade? Let’s break it down in simple, human terms.

What Is the 8th Pay Commission All About?

Every few years, the Government of India reviews how its employees are paid — adjusting for inflation, lifestyle changes, and new economic realities. The 8th Pay Commission, expected to roll out by January 2026, aims to re-evaluate salaries, pensions, and allowances for millions of employees.

For many, this isn’t just a financial change — it’s about dignity, recognition, and the ability to live a little more comfortably after years of service.

Fitment Factor: The Multiplier That Decides Your New Salary

Here’s the term everyone’s talking about — the Fitment Factor. Think of it as a number that multiplies your current basic salary to calculate your new one.

In the 7th Pay Commission, this number was 2.57. Under the upcoming 8th Commission, experts expect it to rise anywhere between 2.5 and 2.8, depending on the government’s fiscal space and inflation trends.

That means your existing pay could see a 30 % to 34 % jump, and for lower pay levels, the hike could even touch 40 %.

For instance, if you’re currently earning ₹18,000 as basic pay, your new pay could land between ₹40,000 – ₹51,000 once the new structure kicks in.

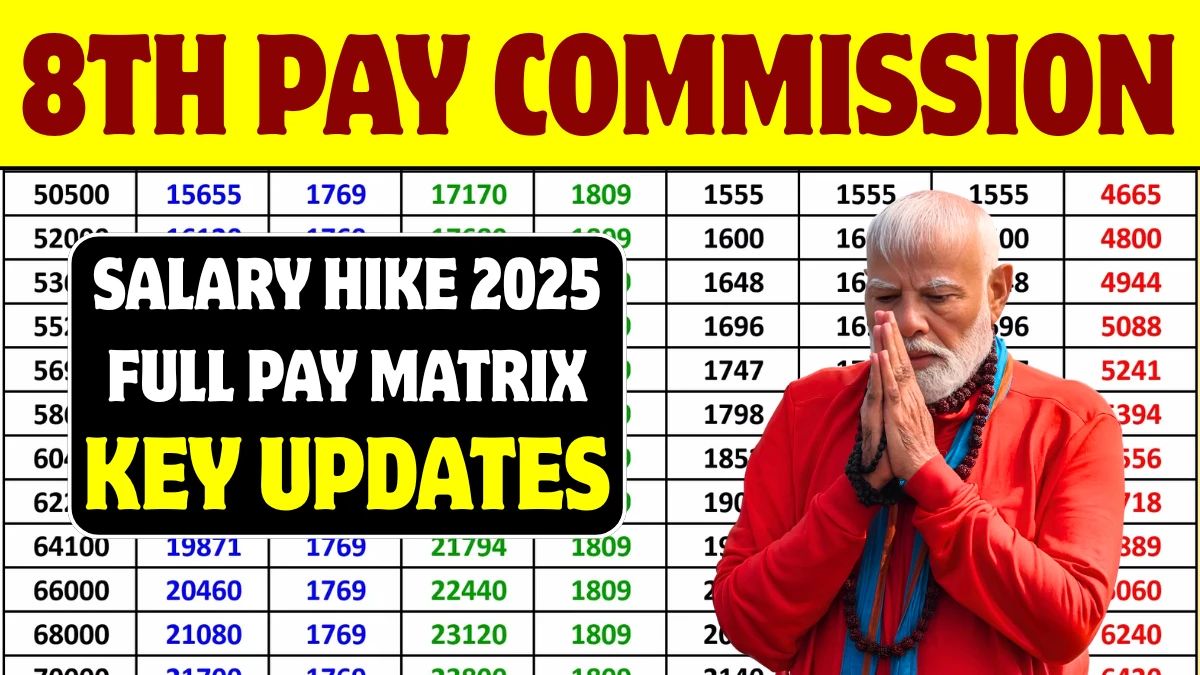

Pay Matrix Revision: What Changes Are Expected

Just like the 7th Pay Commission, the new one will also use a level-based pay matrix — but with higher starting points and updated scales. Each level will see systematic increases that match today’s cost of living.

If the fitment factor goes toward the higher side of projections, even senior and top-level employees may notice meaningful bumps in their monthly pay.

Will Dearness Allowance (DA) Be Merged?

This could be one of the biggest changes. Right now, Dearness Allowance (DA) is a separate part of your salary, added to help offset inflation.

But under the 8th Pay Commission, reports suggest that DA may be merged with basic pay — resetting DA to zero and starting afresh.

If this happens, your future DA increments will be calculated on a higher base, leading to better long-term earnings and pension growth.

Pensioners May See a Big Relief Too

For pensioners, this new structure could bring long-awaited comfort. The merger of DA with basic pay would likely mean higher base pensions, ensuring better monthly payouts.

Retired employees, defense personnel, and family pensioners are all keeping a close eye on this development. For many, it’s not just about the money — it’s about feeling valued even after retirement.

Expected Timeline: When Will It Happen?

While January 2026 is the most talked-about timeline, slight delays are possible. The government still needs to finalize the Terms of Reference (ToR), set up the commission, and get cabinet approvals.

Looking at past trends, the actual rollout could happen in late 2026 or early 2027 — but optimism remains strong that the process will start soon.

Can the Government Afford It?

That’s the million-rupee question. Implementing a new pay commission is expensive. With subsidies, defense expenditure, and infrastructure goals already stretching the budget, the government may walk a fine line between generosity and responsibility.

Analysts say the final fitment factor will likely be a balanced one — rewarding employees while keeping fiscal health in check.

Still, with national elections and public sentiment in the mix, there’s always room for a positive surprise.

What Should Employees Expect Now?

Right now, the best thing employees and pensioners can do is stay informed and avoid rumors. Once the government sets up the official committee, details about salary bands, allowances, and timelines will become clearer.

If you’re planning major financial decisions, it might be wise to consider different scenarios — a moderate hike, a generous one, or a delayed rollout — so you’re ready for whatever happens.